Pennsylvania Tax Calculator 2025. Income tax calculators by state. The pennsylvania income tax example and payroll calculations are provided to illustrate the standard federal tax, state tax, social security and medicare paid during the year when.

The tax calculation below shows exactly how much pennsylvania state tax, federal tax and medicare you will pay when earning 100,000.00 per annum when living and paying your taxes. Calculate your annual salary after tax using the online pennsylvania tax calculator, updated with the 2025 income tax rates in pennsylvania.

20242024 Tax Calculator Teena Genvieve, Estimated tax calculator extension request refund status unclaimed property businesses tax business registration employer withholding exemption verification extension request. Calculated using the pennsylvania state tax tables and allowances for 2025 by selecting your filing status and entering your income for 2025 for a.

Tax rates for the 2025 year of assessment Just One Lap, Curious to know how much taxes and other deductions will reduce your paycheck? The pennsylvania tax calculator is for the 2025 tax year which means you can use it for estimating your 2025 tax return in pennsylvania, the calculator.

Pennsylvania Tax Calculator 2025, Welcome to the 2025 income tax calculator for pennsylvania which allows you to calculate income tax due, the effective tax rate and the marginal tax rate based on your taxable. Pennsylvania has a flat income tax rate of 3.07%, the lowest of all the states with a flat tax.

2025 Pennsylvania State Tax Calculator for 2025 tax return, The tax calculation below shows exactly how much pennsylvania state tax, federal tax and medicare you will pay when earning 12,000.00 per annum when living and paying your taxes. Pennsylvania has a flat income tax rate of 3.07%, the lowest of all the states with a flat tax.

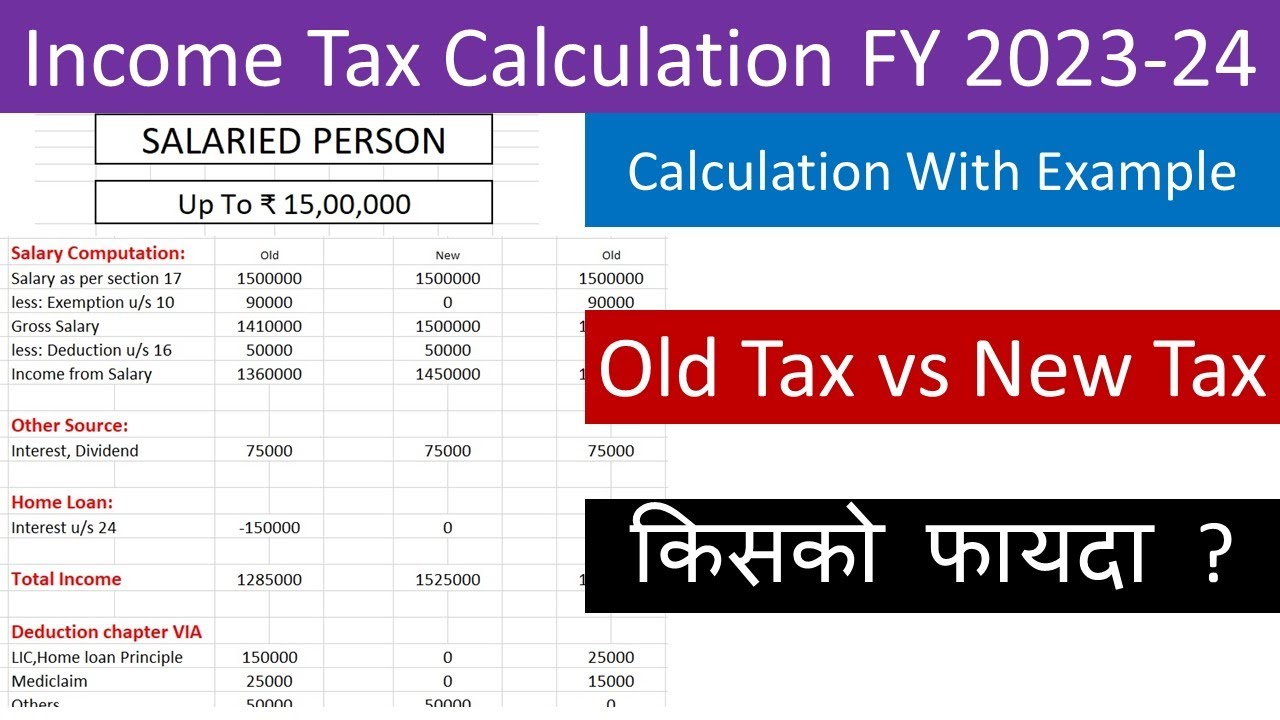

Tax Calculation Spreadsheet in 2025 Excel spreadsheets, Spreadsheet, Here, you will find a comprehensive list of income tax calculators, each tailored to a. Based on this calculation your fica payments for 2025 are $7,344.00.

How to Calculate Payroll Taxes, Methods, Examples, & More (2025), Welcome to the income tax calculator suite for pennsylvania, brought to you by icalculator™ us. The tax calculation below shows exactly how much pennsylvania state tax, federal tax and medicare you will pay when earning 12,000.00 per annum when living and paying your taxes.

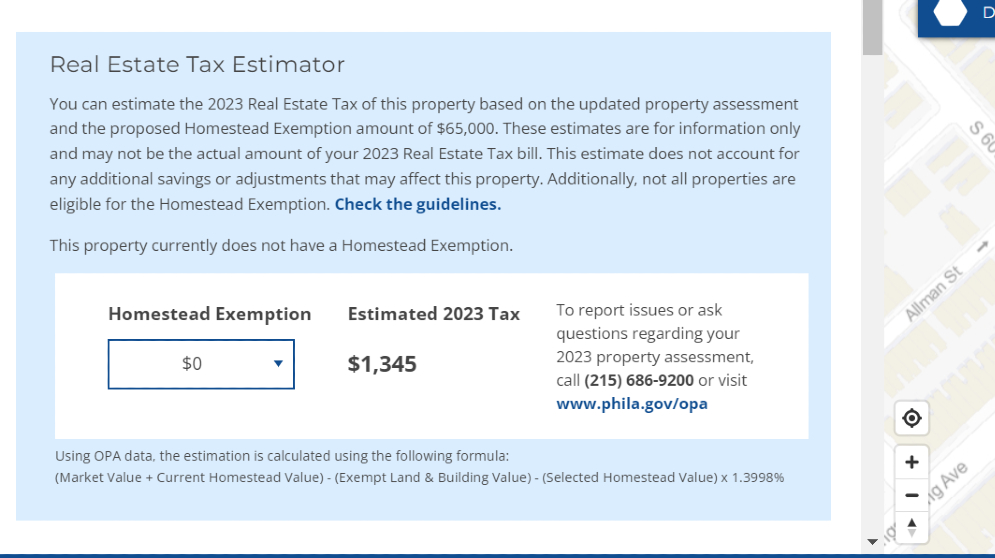

Estimate your 2025 property tax today Department of Revenue City of, Pennsylvania single filer tax tables. The pennsylvania tax calculator is for the 2025 tax year which means you can use it for estimating your 2025 tax return in pennsylvania, the calculator.

Tax Calculator 2025 25 2025 Company Salaries, Calculate your annual salary after tax using the online pennsylvania tax calculator, updated with the 2025 income tax rates in pennsylvania. Welcome to the income tax calculator suite for pennsylvania, brought to you by icalculator™ us.

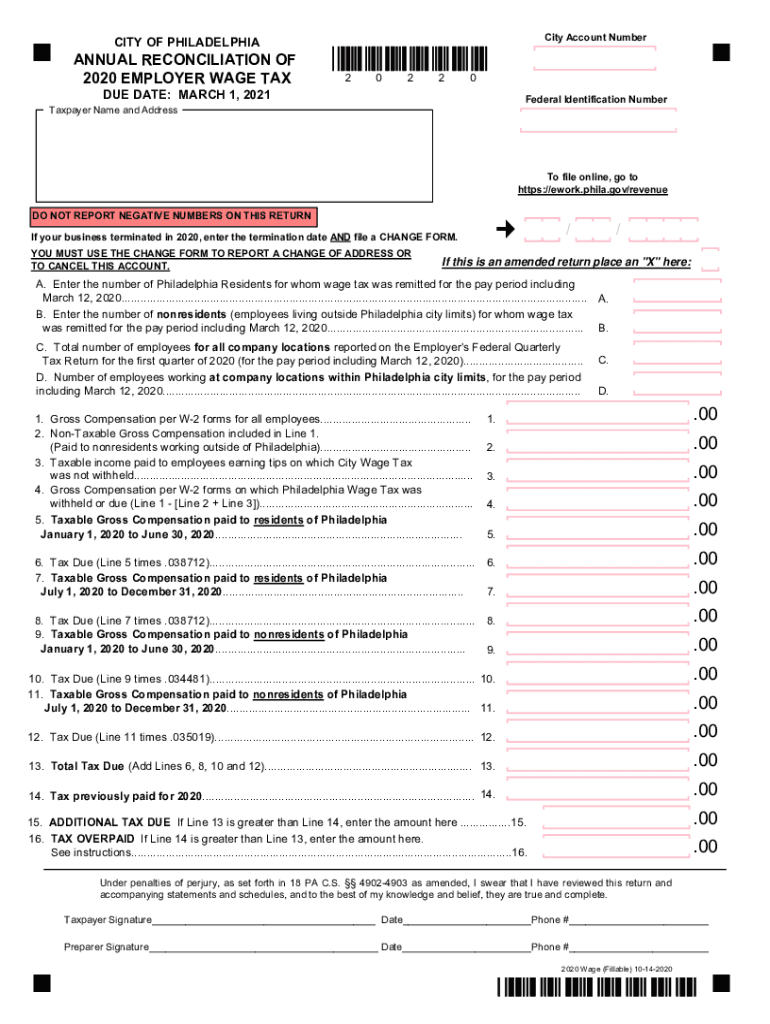

20202024 Form PA Annual Reconciliation of Employer Wage Tax City of, Welcome to the 2025 income tax calculator for pennsylvania which allows you to calculate income tax due, the effective tax rate and the marginal tax rate based on your taxable. Pennsylvania single filer tax tables.

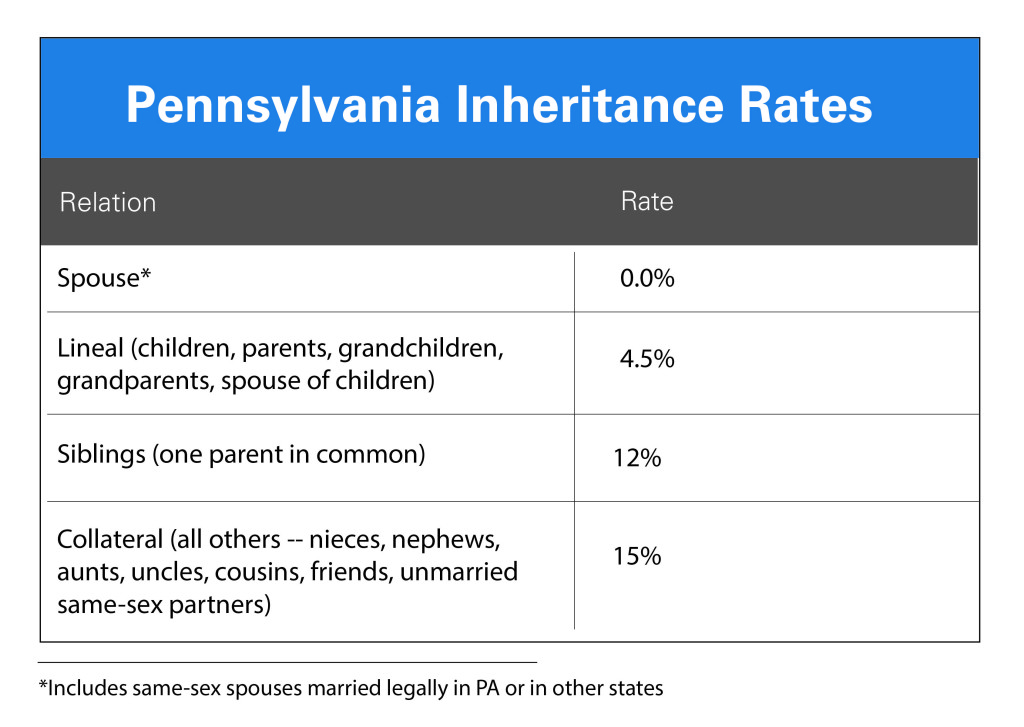

pa inheritance tax family exemption Kendal Isom, Estimated tax calculator extension request refund status unclaimed property businesses tax business registration employer withholding exemption verification extension request. To estimate your tax return for 2025/25, please select the.

The pennsylvania income tax example and payroll calculations are provided to illustrate the standard federal tax, state tax, social security and medicare paid during the year when.

The tax calculation below shows exactly how much pennsylvania state tax, federal tax and medicare you will pay when earning 12,000.00 per annum when living and paying your taxes.